The smart Trick of Insurance Account That Nobody is Discussing

Wiki Article

The Facts About Insurance Uncovered

Table of ContentsA Biased View of InsuranceThe Main Principles Of Insurance Asia Awards The Ultimate Guide To Insurance AsiaInsurance And Investment Things To Know Before You BuyThe Ultimate Guide To Insurance Asia AwardsNot known Incorrect Statements About Insurance Commission

Handicap insurance policy can cover irreversible, short-lived, partial, or overall disability. It does not cover clinical care and also solutions for lasting care. Do you require it? The Facility for Condition Control and also Avoidance states that virtually one in 4 Americans have an impairment that impacts significant life events, that makes this kind of insurance policy sensible for every person, even if you're young and single.

Life Insurance Policy for Kids: Life insurance policy exists to replace lost income. Youngsters have no income. Accidental Death Insurance Coverage: Even the accident-prone ought to skip this sort of insurance. It usually contains so numerous restrictions, that it's almost impossible to accumulate (insurance agent job description). Condition Insurance: A health insurance plan is possibly a much much better investment than trying to cover yourself for each type of condition that's out there.

These are the most vital insurance coverage kinds that offer substantial monetary relief for very realistic situations. Outside of the 5 major types of insurance coverage, you need to think meticulously prior to purchasing any kind of extra insurance.

Some Ideas on Insurance Quotes You Need To Know

Remember, insurance coverage is meant to protect you and also your finances, not hurt them. If you require aid with budgeting, try making use of a bill payment tracker which can help you keep every one of your insurance policy settlements so you'll have a much better grip on your personal funds. Relevant From spending plans as well as expenses to complimentary credit history and also more, you'lldiscover the effortless method to remain on top of it all.There are numerous insurance alternatives, and also lots of monetary specialists will state you need to have them all. It can be hard to identify what insurance coverage you actually need.

Factors such as youngsters, age, way of life, as well as employment benefits play a function when you're building your insurance coverage profile. There are, nonetheless, 4 types of insurance coverage that most economic professionals suggest we all have: life, health and wellness, vehicle, as well as long-lasting special needs.

6 Easy Facts About Insurance Account Shown

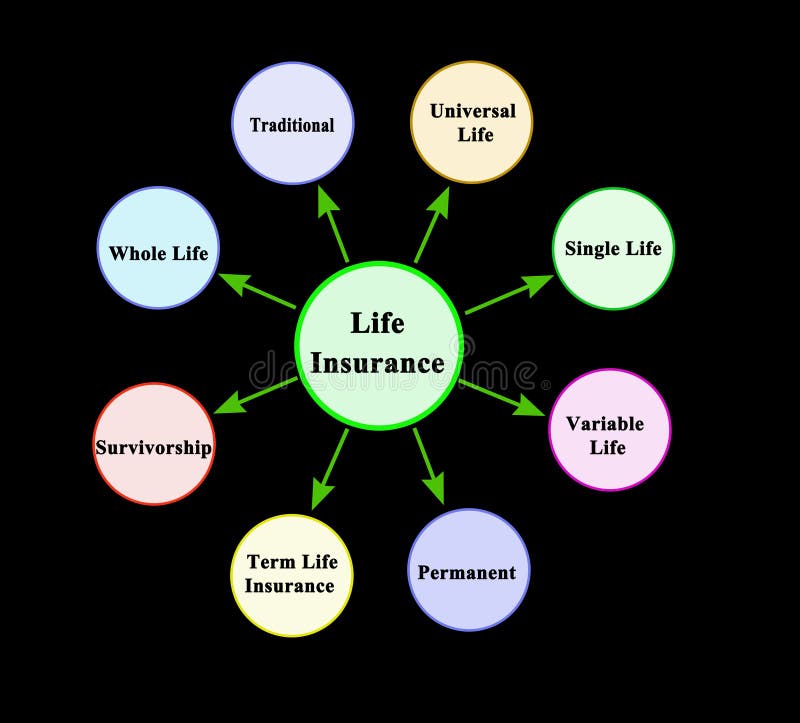

Merely discussed, whole life can be made use of as a revenue device as well as an insurance tool. Term life, on the other hand, is a plan that covers you for a set amount of time.

Usually, also those employees who have fantastic medical insurance, a great nest egg, and a great life insurance policy do the original source not get ready for the day when they could not be able to work for weeks, months, or ever once more. While health and wellness insurance spends for hospitalization and also medical costs, you're still entrusted to those day-to-day expenses that your paycheck typically covers.

The Ultimate Guide To Insurance Agent

Numerous companies offer both short- as well as long-lasting disability insurance as component of their advantages plan. This would be the most effective alternative for protecting affordable disability protection. If your employer does not provide lasting protection, right here are some points to consider prior to purchasing insurance policy on your very own. A plan that ensures income substitute is optimal.7 million vehicle crashes in the U.S. in 2018, according to the National Freeway Traffic Safety Administration. An estimated 38,800 individuals died in cars and truck collisions in 2019 alone. The number one reason of death for Americans between the ages of five and also 24 was automobile accidents, according to 2018 CDC data.

7 million drivers as well as travelers were hurt in 2018. The 2010 economic expenses of auto crashes, consisting of fatalities and also disabling injuries, were around $242 billion. While not all states need drivers to have car insurance coverage, the majority of do have laws concerning economic responsibility in case of a crash. States that do require insurance policy conduct regular arbitrary checks of motorists for evidence of insurance.

The Best Guide To Insurance Commission

If you drive without vehicle insurance and have a crash, penalties will probably be the least of your economic concern. If you, a passenger, or the other driver is hurt in the crash, auto insurance will cover see the costs and also assist protect you versus any lawsuits that may arise from the mishap.Again, as with all insurance coverage, your specific scenarios will certainly identify the expense of car insurance. To make sure you obtain the right insurance policy for you, compare numerous price quotes as well as why not try here the coverage supplied, and also examine occasionally to see if you get approved for reduced prices based upon your age, driving document, or the area where you live (insurance advisor).

If your employer doesn't provide the type of insurance coverage you want, get quotes from several insurance coverage providers. While insurance coverage is pricey, not having it could be much extra pricey.

A Biased View of Insurance Account

Insurance coverage resembles a life jacket. It's a little an annoyance when you don't need it, yet when you do need it, you're greater than glad to have it. Without it, you might be one car accident, health problem or residence fire far from drowningnot in the ocean, but in the red.Report this wiki page